Venture Building

Our Venture Building Philosophy

We have our own philosophy when it comes to venture building.

Camel Mindset

- Efficient burn rate, strong unit economics

- Resilience first: diversify and risk mitigation

- Milestone-driven growth; default alive

- Long-term profitability over short-term hacks

Born Global

- Cross-border by design

- Adjustable business model

- Remote talent pods

- Test → learn → scale across markets

Incremental Innovation

- Optimizing tested business models

- Tech & AI enablement

- Ship small, ship often

- Tight feedback loops

Venture Studio Portfolio

A pipeline of in-house and co-created startups across industries.

We turn validated problems into scalable companies. Our studio supplies the operating system, discovery, validation, build, and early growth, while aligning incentives through shared upside and disciplined governance. The aim: fewer bets, higher hit-rate, and ventures that can stand alone or plug into a parent’s value chain.

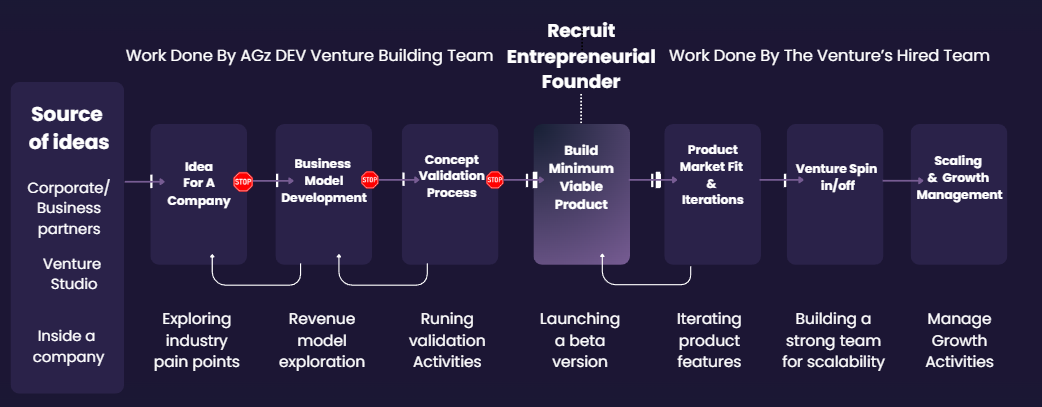

AG’z DEV Venture Building Process

FAQ

We’re a build partner with an evidence-gated operating system. We discover, validate, and co-build with operators, advancing ideas only when data clears go/stop gates (not slideware).

MENAT-centric with cross-border potential, commerce enablement, industrial & sustainability, gov/enterprise solutions, maritime & logistics, and talent & market access.

Submit through “Propose a Venture” or engage as a co-build partner; we evaluate fit and stage before onboarding.

In-house = originated and built by our studio; co-created = built with a partner (corporate, JV, or operator).

Venture Building Fund

A dedicated fund for holdings and organizations to build a high-quality venture portfolio, sustainably and with control.

We finance the ventures we help create. The fund deploys capital into studio-born and co-built startups, accelerating the jump from validation to repeatable growth, while keeping governance tight and incentives aligned.

Who this is for

Holdings & Family Offices seeking a disciplined, build-to-own venture portfolio

Corporates / JVs turning channels, data, IP, or manufacturing into new ventures

Sovereign / Impact Programs aiming for measurable, thesis-aligned outcomes in MENAT

Enterprise Venture Units wanting tighter governance than classic CVC or accelerators

Holdings & Family Offices seeking a disciplined, build-to-own venture portfolio

Corporates / JVs turning channels, data, IP, or manufacturing into new ventures

Sovereign / Impact Programs aiming for measurable, thesis-aligned outcomes in MENAT

Enterprise Venture Units wanting tighter governance than classic CVC or accelerators

When to useYou want 3–5 ventures over 3–5 years, quality over quantity

You have strategic assets to leverage (distribution, data, licenses) but lack a repeatable build engine

You need evidence before capital (pilots, LOIs, unit economics) to avoid spray-and-pray

You prefer control & transparency: milestone gates, IC reviews, and clear ownership

You want 3–5 ventures over 3–5 years, quality over quantity

You have strategic assets to leverage (distribution, data, licenses) but lack a repeatable build engine

You need evidence before capital (pilots, LOIs, unit economics) to avoid spray-and-pray

You prefer control & transparency: milestone gates, IC reviews, and clear ownership

How we workDesign – Define theses, governance, budget envelope, KPIs, and IC cadence

Deploy – Source from your IP + our theses; run Discover → Validate → Build sprints

Decide at Gates (G1/G2/G3) – Commit, pause, or stop based on pre-agreed metrics

Scale / Spin-off – Establish boards, co-investment lanes, and reporting; scale inside or spin off

Design – Define theses, governance, budget envelope, KPIs, and IC cadence

Deploy – Source from your IP + our theses; run Discover → Validate → Build sprints

Decide at Gates (G1/G2/G3) – Commit, pause, or stop based on pre-agreed metrics

Scale / Spin-off – Establish boards, co-investment lanes, and reporting; scale inside or spin off

Deliverables to expectFund Blueprint: theses, governance, investment policy, IC template

Pipeline & Scorecards: ranked ideas (market • feasibility • strategic fit)

Venture Dossiers: problem, solution, business model, validation plan, KPIs

Pilot Packs: MVP plan, budget, team, risk log, partner/intros list

Metrics & Dashboards: traction, unit economics, sales motion, runway

Gate Memos: G1/G2/G3 decision documents with pass/hold/stop rationale

Scale/Spin-off Pack: structure options, cap table scenarios, board setup, reporting cadence

Fund Blueprint: theses, governance, investment policy, IC template

Pipeline & Scorecards: ranked ideas (market • feasibility • strategic fit)

Venture Dossiers: problem, solution, business model, validation plan, KPIs

Pilot Packs: MVP plan, budget, team, risk log, partner/intros list

Metrics & Dashboards: traction, unit economics, sales motion, runway

Gate Memos: G1/G2/G3 decision documents with pass/hold/stop rationale

Scale/Spin-off Pack: structure options, cap table scenarios, board setup, reporting cadence

Who this is for

Holdings & Family Offices seeking a disciplined, build-to-own venture portfolio

Corporates / JVs turning channels, data, IP, or manufacturing into new ventures

Sovereign / Impact Programs aiming for measurable, thesis-aligned outcomes in MENAT

Enterprise Venture Units wanting tighter governance than classic CVC or accelerators

When to use

You want 3–5 ventures over 3–5 years, quality over quantity

You have strategic assets to leverage (distribution, data, licenses) but lack a repeatable build engine

You need evidence before capital (pilots, LOIs, unit economics) to avoid spray-and-pray

You prefer control & transparency: milestone gates, IC reviews, and clear ownership

How we work

Design – Define theses, governance, budget envelope, KPIs, and IC cadence

Deploy – Source from your IP + our theses; run Discover → Validate → Build sprints

Decide at Gates (G1/G2/G3) – Commit, pause, or stop based on pre-agreed metrics

Scale / Spin-off – Establish boards, co-investment lanes, and reporting; scale inside or spin off

Deliverables to expect

Fund Blueprint: theses, governance, investment policy, IC template

Pipeline & Scorecards: ranked ideas (market • feasibility • strategic fit)

Venture Dossiers: problem, solution, business model, validation plan, KPIs

Pilot Packs: MVP plan, budget, team, risk log, partner/intros list

Metrics & Dashboards: traction, unit economics, sales motion, runway

Gate Memos: G1/G2/G3 decision documents with pass/hold/stop rationale

Scale/Spin-off Pack: structure options, cap table scenarios, board setup, reporting cadence

FAQ

No. It’s a fund built around your strategy and assets, focused on a small, high-conviction portfolio (typically 3–5 ventures).

Plan for 3–5 years to design, deploy, and scale a 3–5 venture portfolio, with IC reviews and go/hold/stop gates each sprint.

Funding is milestone-based: each tranche unlocks only when pre-agreed KPIs are met (e.g., pilot results, retention, revenue), preventing over-funding.

IP/ownership sits with the venture or JV per the agreement you approve. You retain oversight via IC governance, dashboards, and board seats at scale/spin-off.

Venture Building as a Service

Offering corporates and investors our venture-building expertise as a structured service.

We plug a venture studio inside your organization, discovering problems worth solving, validating solutions with customers, and building pilots that can scale or spin off. You get a repeatable operating system (gates, KPIs, governance) and an operator bench that ships.

Who this is for

Corporates & JVs seeking new revenue lines, spin-outs, or digitization beyond the core

Investors & family offices developing theses and co-building ventures around strategic assets

Public/NGO programs targeting priority challenges with build-and-transfer models

When to use it

You have assets (channels, data, manufacturing, licenses) but no focused build engine

You need evidence before big capex (LOIs, pilots, unit economics)

You want speed with governance (clear decision rights and stop/scale rules)

Who it’s for

Corporates & JVs seeking new revenue lines, spin-outs, or digitization beyond the core

Investors & family offices developing theses and co-building ventures around strategic assets

Public/NGO programs targeting priority challenges with build-and-transfer models

Corporates & JVs seeking new revenue lines, spin-outs, or digitization beyond the core

Investors & family offices developing theses and co-building ventures around strategic assets

Public/NGO programs targeting priority challenges with build-and-transfer models

When to use it

You have assets (channels, data, manufacturing, licenses) but no focused build engine

You need evidence before big capex (LOIs, pilots, unit economics)

You want speed with governance (clear decision rights and stop/scale rules)

You have assets (channels, data, manufacturing, licenses) but no focused build engine

You need evidence before big capex (LOIs, pilots, unit economics)

You want speed with governance (clear decision rights and stop/scale rules)

How we work

Embedded squad: product + growth + finance operator(s) working with your BU lead

Evidence-gated cadence: weekly steering, KPI dashboards, unblockers

Partner leverage: we use your distribution/data/capex only where it accelerates traction

Embedded squad: product + growth + finance operator(s) working with your BU lead

Evidence-gated cadence: weekly steering, KPI dashboards, unblockers

Partner leverage: we use your distribution/data/capex only where it accelerates traction

Deliverables to expect

Innovation scorecard & ranked pipeline

Concept dossiers and pilot playbooks (team, budget, milestones, risks)

MVPs and pilot reports with customer signals/LOIs

Metrics pack (unit economics, retention, sales motion) and governance kit

Spin-off/scale pack (structure options, roles, reporting

Innovation scorecard & ranked pipeline

Concept dossiers and pilot playbooks (team, budget, milestones, risks)

MVPs and pilot reports with customer signals/LOIs

Metrics pack (unit economics, retention, sales motion) and governance kit

Spin-off/scale pack (structure options, roles, reporting

How we work

Embedded squad: product + growth + finance operator(s) working with your BU lead

Evidence-gated cadence: weekly steering, KPI dashboards, unblockers

Partner leverage: we use your distribution/data/capex only where it accelerates traction

Deliverables to expect

Innovation scorecard & ranked pipeline

Concept dossiers and pilot playbooks (team, budget, milestones, risks)

MVPs and pilot reports with customer signals/LOIs

Metrics pack (unit economics, retention, sales motion) and governance kit

Spin-off/scale pack (structure options, roles, reporting)

FAQ

Discovery can begin within weeks once scope and sponsor are set.

A BU lead/product owner, a technical counterpart, and an executive sponsor for gate decisions.

Yes, each sprint is standalone. Many clients start with Discovery or Validation, then extend.

If evidence supports it, we structure the spin-off/JV and can co-build; economics and IP are defined upfront.